Different Types of Cryptocurrencies: Bitcoin, altcoin, and tokens

I still remember the days when I could count the various types of cryptocurrencies available. But this is certainly not the case as of today. The crypto market has grown exponentially. These different types of Crypotos have been coming up to solve different use cases or pain points.

The underlying technology of cryptocurrency is blockchain. Cryptocurrencies are a relatively new type of money. A cryptocurrency is a digital currency in which transactions are verified using Blockchain Cryptography techniques rather than a verification by a central authority. In simple terms, the state is maintained through a distributed consensus.

This article will discuss the different types of major ones classified into three categories: Bitcoin, altcoin, and tokens.

Bitcoin

Bitcoin is the first blockchain that Satoshi Nakamoto, whose identity is unknown even today, proposed in a white paper. With the paper’s release, a new technology revolution started, which no one could have guessed at its release in 2008. Bitcoin has found use cases in both ethical and, unfortunately, unethical use cases. It was Bitcoin that introduced the revolutionary blockchain technology.

NOTE: Before Bitcoin, many cryptocurrencies came up; however, Bitcoin was revolutionary as it introduced decentralized and distributed networks.

Bitcoin is nothing but the money you can send to others digitally. Therefore, there is no need for a central physical authority such as a bank. For Bitcoins, there is no involvement of any banks, and it is a decentralized network. So, we can carry out transactions without revealing our identity.

The Bitcoin network is a peer-to-peer payment network. Therefore, it can have transactions only in the form of bitcoins. What it means is that we can send or receive bitcoins by moving them from one node in the network to another node in the network.

You may also like to refer to the article about blockchain technology to know more about the decentralized network transaction process in a blockchain.

Altcoins

After Bitcoin, many different blockchains came up to improve usage and support multiple use cases. A few of these had significant changes, and some had minor changes. NEO, Litecoin, and Ether are primary examples of altcoins.

Altcoins are an alternative version of the bitcoin with minor modifications. A few altcoins derived from Bitcoin and having minor modifications are Namecoin, Litecoin, Dogecoin, etc.

Not all altcoins introduced were minor improvements. There are few Altcoins that differ majorly from bitcoin. For example, NEO and Ether are fundamentally the same but quite different from Bitcoin.

It is also important to note that NEO and Ether are not designed to be treated as digital currencies. Instead, they find their core applications to build applications. They provide a setup for developers to utilize all the benefits of the blockchain and build decentralized applications. Such apps are also called DApps (Decentralized Apps).

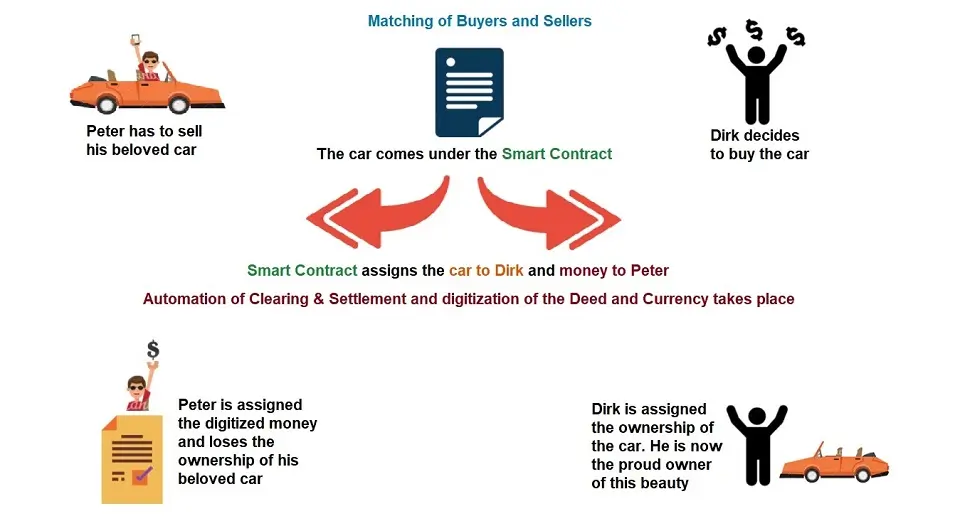

Creating applications was possible because the Ethereum blockchain network introduced a new concept called a smart contract. A smart contract automatically executes the contract (or a script) based on the defined rules. Ether is a cryptocurrency traded on the Ethereum blockchain network.

Unlike bitcoin networks, which are about the digital transmission of bitcoins, Smart Contracts supports any transactions in a decentralized way. For example, buying a house, renting a car, procuring raw materials, etc.

Obviously, we cannot put a physical asset, say a house, on the network to support the buying. But we can easily add a contract to the network representing the house. This is one of the Smart Contract features that helps tokenize the assets available in the physical world on the blockchain network.

Altcoin Ether of Ethereum Blockchain Platform

Ether is a cryptocurrency built on the Ethereum Blockchain platform. Let’s discuss all the details about it:

Ethereum

Ethereum is famous as the first and most prominent altcoin to introduce smart contract functionality into the blockchain ecosystem. It was launched in 2015 by a team including Vitalik Buterin. Ethereum expanded the possibilities of blockchain technology beyond Bitcoin’s original scope of peer-to-peer digital currency.

Ethereum Smart Contracts and DApps

The core innovation that Ethereum brought to the table was the concept of a smart contract. As smart contract is essentially a self-executing contract with the terms of the agreement directly written into lines of code.

Smart contracts run on the blockchain, which means they operate in a decentralized and tamper-proof environment. This groundbreaking feature opened the door for developers to create decentralized applications (DApps). These decentralized applications run on a peer-to-peer network of computers rather than a single computer.

Ether – The Altcoin

Ethereum’s native cryptocurrency, Ether (ETH), serves a dual purpose as both a digital currency and a means to run applications within the network. To execute operations on the Ethereum network, users need to use Ether as a form of “fuel”. This fuel is also known as “gas” to compensate for the computing energy required to process and validate transactions.

Ethereum 2.0

As part of its ongoing evolution, Ethereum has undergone a series of upgrades. The previous upgrade is Ethereum 2.0, which aims to address the network’s scalability and security.

A significant component of these upgrades is the transition from a Proof of Work (PoW) consensus mechanism. This transition requires energy-intensive mining to a Proof of Stake (PoS) system. The Proof of Stake system aims to be more energy-efficient and secure. For this, it allows users to validate transactions according to how many coins they hold and is willing to “stake” as collateral.

Decentralized Finance and NFTs

Ethereum’s flexibility and robust programming capabilities have made it the backbone of various emerging fields in the crypto space. It is the platform of choice for most Decentralized Finance (DeFi) projects, which seek to recreate traditional financial systems with fewer intermediaries.

Additionally, Ethereum’s supports ERC-721. The ERC-721 is a standard for representing non-fungible tokens (NFTs). Supporting ERC-721 has positioned Ethereum at the forefront of the NFT boom, representing ownership of digital and occasionally physical assets.

Ether: A Catalyst for Innovation

Ethereum has established itself as more than just a cryptocurrency. It’s a platform for innovation and development within the blockchain space. Its ability to execute complex contracts and support many applications positions it as a key infrastructure for the future of decentralized systems.

XRP from RippleNet of Ripple

Ripple is both a platform and a currency. The Ripple platform is an open-source protocol that enables fast and cheap digital transactions. It has a unique approach to cryptocurrency through its focus on improving existing banking systems with the power of blockchain technology.

XRP

Ripple refers to the company and the network behind XRP cryptocurrency. XRP is the token representing the transfer of value across the Ripple Network. The main purpose of XRP is to act as an intermediary mechanism of exchange between two currencies or networks—as a temporary settlement layer denomination.

The Ripple Network

Ripple’s network, known as RippleNet, is a network of institutional payment providers. These payment providers are banks and money services businesses that use solutions developed by Ripple for global money transfers.

The idea is to allow for a direct transfer of assets that settle in real time. Moreover, it must be more reliable and incur lower fees than traditional payment networks like SWIFT.

XRP Ledger: A Consensus Ledger

Unlike Bitcoin or Ethereum, Ripple does not operate on a proof-of-work (PoW) nor a proof-of-stake (PoS) consensus mechanism. Instead, it uses a unique distributed consensus mechanism through a network of servers to validate transactions. This allows for rapid and energy-efficient processing of transactions.

The XRP Ledger is an open-source blockchain platform that provides a seamless experience for transferring money. It is the underlying infrastructure for the XRP cryptocurrency. The Ledger is maintained by various independent participants of a global “XRP Community,” of which Ripple is an active member.

Use Cases for XRP

XRP’s use cases primarily focus on payment scenarios where traditional systems are too slow or costly. Remittances, international money transfers, and cross-border payments are areas where XRP is particularly aimed at making a significant impact.

Litecoin: The Silver to Bitcoin’s Gold

Litecoin (LTC), created by Charlie Lee in 2011, is a peer-to-peer cryptocurrency developed as a ‘lighter’ version of Bitcoin. It was one of the first cryptocurrencies to follow in the footsteps of Bitcoin and has often been referred to as the silver to Bitcoin’s gold.

Litecoin’s Speed and Efficiency

One of the main differences between Litecoin and Bitcoin is its block generation time. Litecoin has a faster block generation time, targeting 2.5 minutes compared to Bitcoin’s 10 minutes. This means Litecoin can confirm transactions roughly four times as fast as Bitcoin.

Scrypt Hashing Algorithm of Litecoin

While Bitcoin uses the SHA-256 hashing algorithm, Litecoin uses a memory-hard, scrypt-based mining proof-of-work algorithm. This is to target regular computers and GPUs that most people already have, which are its main differentiators from Bitcoin mining.

Limited Supply of Litecoin

Like Bitcoin, Litecoin has a finite supply limit. There will only ever be 84 million Litecoins mined, exactly four times the number of Bitcoin units. The intention behind the increased supply is to make Litecoin more accessible for smaller transactions.

Litcoin’s Adoption and Use Cases

Several merchants widely accept Litecoin. Therefore, its use has been a testing ground for technological developments for possible implementations in Bitcoin. These include Segregated Witness (SegWit) and the Lightning Network, implemented on Litecoin before Bitcoin.

Litecoin’s Vision

Charlie Lee envisioned Litecoin as a complementary currency to Bitcoin. The intention was necessarily to replace Bitcoin but rather for smaller transactions. The transactions require faster confirmation times, lower fees, and more bandwidth due to the higher total supply.

Market Position of Litecoin

Most cryptocurrencies have surpassed Litecoin in terms of innovation and market capitalization. However, Litecoin has maintained a relatively stable position in the market due to its established platform and large user base.

Stablecoins: Combining Cryptography with Stability

Stablecoins represent a key innovation in the cryptocurrency space. The creation of Stablecoins was to tackle the issue of volatility, which is common with other cryptocurrencies like Bitcoin and Ethereum. They are digital currencies pegged to stable assets. The stable assets the Stablecoins peg to include currencies (e.g., USD, EUR, GBP), commodities (e.g., gold), or other cryptocurrencies.

Pegging Mechanisms of Stablecoins

The value of a stablecoin is typically pegged to its underlying asset at a 1:1 ratio. There are several mechanisms to maintain this peg. These are as follows:

- Fiat-Collateralized Stablecoins: These stablecoins reserve a specific fiat currency as collateral to issue a proportional number of tokens. Examples include USDT (Tether), USDC (USD Coin), and PAX (Paxos Standard).

- Commodity-Collateralized Stablecoins: Similar to their fiat counterparts, reserves of commodities like gold or oil back these stablecoins. An example is PAX Gold (PAXG). For PAXG, each token is backed by one fine troy ounce of a 400 oz London Good Delivery gold bar.

- Crypto-Collateralized Stablecoins: These are pegged to other cryptocurrencies. However, they maintain a higher reserve ratio to account for the volatility of the underlying assets. DAI is a prominent example, pegged against the US dollar but backed by Ether.

- Algorithmic Stablecoins: Instead of using reserves, these stablecoins use algorithms to control the supply of tokens in circulation. This is much like a central bank’s approach to maintaining the value of its currency.

Advantages of Stablecoins

- Price Stability: Their stable value makes them ideal for everyday transactions, wage payments, and as a medium of exchange in the crypto economy.

- Efficient Cross-Border Transactions: They combine the instant processing and security of cryptocurrencies with the stable valuations of fiat currencies.

- Reduced Volatility: For investors and traders, they offer a way to escape the extreme volatility of other cryptocurrencies without converting capital back into fiat money.

Stablecoins: Criticism and Risks

- Regulatory Scrutiny: Due to their connection to traditional financial systems, stablecoins face significant regulatory challenges. Governments and financial authorities are concerned about how they might affect monetary policy, financial stability, and compliance with international regulations.

- Transparency and Trust: For fiat and commodity-backed stablecoins, there is a need for regular audits to ensure that the issued tokens are fully backed by the reserves they claim to hold. Lack of transparency has led to skepticism and legal issues for certain stablecoin projects.

Stablecoins’s Role in the Crypto Ecosystem

Stablecoins have become integral to the crypto ecosystem. Particularly in decentralized finance (DeFi) platforms, where they are frequently used to lend, borrow, or earn interest without the risk associated with other cryptocurrencies’ price volatility.

Stablecoins serve as a bridge between traditional finance and the novel crypto economy. They provide a less volatile entry point for both private and institutional participants.

Privacy Coins: Anonymity in the Cryptosphere

Privacy Coins take the foundational idea of cryptocurrency. They are decentralized, peer-to-peer money—and enhance it by obscuring the details of transactions. This privacy is to ensure that the transfer details remain private. Unlike Bitcoin, where transactions are open to the public and traceable, privacy coins use various cryptographic techniques to keep users and transactions anonymous.

Techniques for Privacy

- Ring Signatures (as used by Monero [XMR]): Ring signatures mix a user’s account keys with public keys from the blockchain to create a ‘ring’ of signers. This makes it extremely difficult to link any transaction back to the original user.

- Stealth Addresses: These are one-time addresses generated for each transaction on behalf of the recipient. This enhances privacy by preventing transactions linking to the recipient’s published address.

- Zero-Knowledge Proofs (as used by Zcash [ZEC]): This allows one party to prove to another that a statement is true. They do it without conveying any information apart from the fact that the statement is true.

- CoinJoin (as implemented by Dash [DASH] and other currencies): This method combines multiple user payments into one transaction. This makes it harder to determine which funds went to where.

Notable Privacy Coins:

- Monero (XMR): Monero is widely recognized for its privacy features. It uses ring signatures and stealth addresses to obscure the origins, amounts, and destinations of all transactions.

- Zcash (ZEC): Zcash offers the option of “shielded” transactions. This allows for encryption of content using zero-knowledge proofs called zk-SNARKs.

- Dash (DASH): Originally known as Darkcoin, it offers more anonymity as it works on a decentralized mastercode network that makes transactions almost untraceable.

Privacy Coins: Controversies and Legal Standing

Privacy coins are often at the center of a heated debate. Advocates argue they protect users’ rights to privacy, especially in authoritarian regimes where financial surveillance is a tool for repression. However, there has been criticism for their potential use in illegal activities due to their enhanced anonymity features.

Regulatory Challenges for Privacy Coins

As global financial regulators ramp up efforts to combat money laundering and terrorist financing, privacy coins face increased scrutiny. Exchanges in some jurisdictions may delist them to comply with regulations, affecting their availability and price.

Importance of Privacy Coins for the Blockchain Ecosystem

Despite the controversies, privacy coins are crucial in the larger blockchain ecosystem. Privacy coins push the boundaries of cryptographic research and their underlying technologies. They often find use in enhancing the privacy features of other cryptocurrencies.

Tokens

Tokens are like vouchers. If we have a voucher to shop for groceries, we cannot use it for any other purpose besides purchasing groceries. Similarly, if we have a token for a particular application, we can only use it for its specific purpose.

As an example, let’s say that Facebook builds its application on the blockchain network. They facilitate tokens to like, share, comment, or post content (basically any action users can currently do on Facebook). In such a case, we can use these tokens only on Facebook and not Twitter.

In simple terms, the key difference between the Altcoins and tokens is that,

- We can consider Altcoins as a currency used to buy products and services in the marketplace.

- However, Tokens have a specific purpose. They don’t have value outside the particular application or use case where we use them. Their value is only for the specific services or products.

Blockchain tokens are classified in the following categories:

- Utility Tokens: These provide access to a service or platform.

- Security Tokens: These represent investment contracts and are often subject to securities regulation.

- DeFi Tokens: Tokens specifically designed for use in decentralized finance applications.

- Governance Tokens: These give holders the right to vote on the future of a decentralized protocol.

- NFTs (Non-Fungible Tokens): Unique tokens representing ownership of a specific item or content, usually on the Ethereum blockchain.

Let’s deep dive to see what all the above types of blockchain tokens mean:

Utility Tokens: Beyond Mere Currency

Utility Tokens represent a category of cryptocurrency that is not a digital form of money. Rather, they serve a specific purpose within their native platform or ecosystem. Unlike security tokens, which represent an investment into a project with the expectation of profit, utility tokens provide users access to a product or service.

Functionality and Use Cases of Tokens

- Access: Utility tokens can grant holders the right to access a future service or product. A common example is a token that allows users to purchase cloud storage or processing power.

- Network Fees: In some platforms, we require utility tokens to pay for network fees, services, or other functionalities. For instance, we may need them to execute smart contracts or to reward network participants.

- Participation: They can allow users to participate in network governance, where token holders can vote on decisions that affect the project’s direction.

Characteristics of Tokens

- Not for Investment: While utility tokens may increase in value, their primary purpose is not speculation. Their value is often related to their utility within their platform rather than potential returns on investment.

- Platform-Specific: Utility tokens are usually tied to a specific blockchain project or company and are used within that particular ecosystem.

- Regulatory Landscape: As they do not represent a stake in a company’s earnings or success, utility tokens may face less regulatory scrutiny than security tokens, although this landscape is rapidly evolving.

Notable Examples of Utility Tokens

- Ethereum’s Ether (ETH): Although Ether is a cryptocurrency, it also functions as a utility token for the Ethereum network, used to pay transaction fees and computational services.

- Filecoin (FIL): Filecoin tokens’ use is for buying and selling storage space on the network.

- Golem (GNT): Golem’s tokens are to pay for computational power on their decentralized cloud computing network.

Considerations for Users: Before acquiring utility tokens, users should consider the utility’s relevance and demand, the project’s stage of development, and the team’s track record. Utility tokens are best for using them as intended in their respective platforms, not for speculative purposes.

The Value Proposition: The determination of the real value of a utility token is by its usefulness and the demand for the service it provides access to. As the blockchain space continues to mature, utility tokens stand as a testament to the practical application of blockchain technology beyond financial transactions.

Security Tokens: Digital Representation of Investment

Security Tokens are a type of cryptographic token representing a share of an asset, such as real estate, a company, or participation in an investment fund. They are digital, liquid contracts for fractions of any asset that already has value, like real estate, a car, or corporate stock.

Characteristics of Security Tokens

- Investment Products: Unlike utility tokens, which grant access to a service or product, security tokens represent an investment holding with an expectation of profit.

- Regulation: These tokens are subject to federal securities regulations, as they are considered securities. Issuers must comply with these regulations when issuing a security token, which includes providing detailed information about the investment product and often conducting Know Your Customer (KYC) and Anti-Money Laundering (AML) checks.

- Ownership Rights: Investors in security tokens typically have ownership rights, including dividends, revenue shares, voting rights, or other financial benefits.

- Trading on Security Token Exchanges: Post-issuance, security tokens can often be traded on licensed security token exchanges, providing liquidity to assets that are traditionally illiquid.

Advantages of Security Tokens

- Increased Liquidity: We can trade them on secondary markets, providing liquidity to traditionally illiquid assets.

- Fractional Ownership: Security tokens allow assets to be divided into smaller units, opening up investment opportunities to a broader range of investors.

- Automation of Compliance: Through smart contracts, they can automate various aspects of compliance, reducing the need for intermediaries.

- Global Investor Pool: They have the potential to be accessible by a global pool of investors, potentially increasing the capital they can raise.

Examples of Security Tokens

- Real Estate Tokens: Represent fractional ownership in a property or pool of properties.

- Equity Tokens: Represent equity in a startup or established business.

- Debt Tokens: Represent a debt or cash-flow stream akin to a short-term bond or syndicated loan.

Challenges and Considerations: Security tokens are still a novel concept facing considerable regulatory challenges. The legal framework around these assets is still developing, and potential investors should be aware of the implications, including the potential for regulatory changes that could affect the token’s value and legality.

The Future of Security Tokens: As the regulatory environment evolves, security tokens may redefine traditional financial markets, providing a more efficient, transparent, and secure way of making investments and transferring ownership of assets.

DeFi Tokens: The Fuel of Decentralized Finance

DeFi Tokens are at the heart of the decentralized finance (DeFi) ecosystem, which encompasses financial services like borrowing, lending, and trading, built on blockchain technology. These tokens enable and govern the various DeFi platforms and protocols that aim to replicate and improve upon traditional financial systems.

Characteristics of DeFi Tokens

- Utility and Governance: DeFi tokens often serve multiple purposes within their ecosystems, including paying for transaction fees, participating in governance decisions through voting, and incentivizing users.

- Yield Farming and Liquidity Mining: You can earn many DeFi tokens through yield farming or liquidity mining, where users provide liquidity to a DeFi protocol and receive tokens as a reward.

- Non-Custodial: DeFi applications are typically non-custodial, meaning users retain full control over their tokens and do not need to trust a central party to manage their funds.

Examples of DeFi Tokens

- Maker (MKR) and Dai (DAI): MKR is a governance token for the MakerDAO and Maker Protocol, while DAI is a stablecoin pegged to the US dollar, generated through loans on the Maker system.

- Compound (COMP): COMP tokens allow holders to participate in the governance of the Compound protocol, a platform for decentralized lending and borrowing.

- Uniswap (UNI): UNI is the governance token for Uniswap, a decentralized exchange that allows for the automated trading of DeFi tokens.

Benefits of DeFi Tokens

- Financial Inclusion: By using DeFi tokens, individuals worldwide can access financial services without the need for traditional bank accounts or fiat currency.

- Innovation: The DeFi space is famous for its rapid innovation, with tokens often at the forefront of new financial products and services.

- Interoperability: Many DeFi tokens are built on common standards (like ERC-20 on Ethereum), facilitating interoperability between different DeFi applications.

Tokens: Risks and Challenges

- Volatility: The value of DeFi tokens can be highly volatile, subject to the rapid shifts in supply and demand characteristic of new and emerging markets.

- Regulatory Uncertainty: The DeFi space is relatively new and thus faces significant regulatory uncertainty, which could impact the value and legality of DeFi tokens.

- Smart Contract Risks: DeFi platforms run on smart contracts, which, if not audited properly, can contain vulnerabilities that hackers might exploit.

The Future of DeFi Tokens: DeFi tokens represent a foundational shift in how individuals engage with financial services, emphasizing a permissionless and open financial ecosystem. As DeFi continues to grow, these tokens will likely play an increasingly critical role in the future of finance.

Governance Tokens: Empowering Community-Led Decisions

Governance Tokens are a type of cryptocurrency that grants holders the power to influence decisions concerning the development and management of a blockchain project. These tokens are at the forefront of decentralized governance, enabling a shift from traditional, centralized control to a more democratic, user-led approach.

Key Features of Governance Tokens

- Voting Rights: Token holders can propose changes to the protocol or vote on proposed changes by others. The weight of one’s vote is typically proportional to the number of tokens held.

- Proposing Changes: In some ecosystems, holding a certain amount of governance tokens allows you to propose governance actions or improvements.

- Delegate Voting: Holders can delegate their voting rights to others, allowing trusted community members or experts to vote on their behalf.

Examples of Governance Tokens

- Aave (AAVE): AAVE token holders can vote on changes to the Aave protocol, like adding new features or altering key parameters.

- Compound (COMP): COMP gives users a say in the Compound protocol’s governance, allowing them to suggest, debate, and implement changes to the system.

- Decentraland (MANA): MANA allows users to vote on policy updates, land auctions, and the types of content allowed within the Decentraland virtual world.

Benefits of Governance Tokens

- Decentralization: Governance Tokens can help ensure that control over a protocol is distributed across a broad base of users rather than concentrated in the hands of a few.

- Alignment of Interests: They can align the interests of the users with the interests of the protocol, as token holders are incentivized to make decisions that increase the value of the protocol and its token.

- Community Engagement: They foster a strong sense of community and encourage active participation in the protocol’s future.

Governance Tokens: Risks and Challenges

- Voter Apathy: The effectiveness of governance tokens relies on a sufficiently large and engaged voting base, which isn’t always present.

- Plutocracy Concerns: If a small number of holders accumulate a large percentage of the tokens, it can lead to a concentration of power and decision-making.

- Complexity of Governance: The processes and mechanics of decentralized governance can be complex and difficult for average users to understand and participate in effectively.

The Evolution of Governance Tokens

As blockchain and DeFi projects grow, governance tokens could redefine organizational governance, offering a real-world testing ground for decentralized and democratic decision-making on a large scale.

Non-Fungible Tokens (NFTs): Unique Digital Assets

Non-Fungible Tokens (NFTs) are cryptographic assets on a blockchain with unique identification codes and metadata that distinguish them from each other. Unlike cryptocurrencies like Bitcoin and many network tokens, NFTs are not mutually interchangeable. Therefore, we cannot exchange them on a one-to-one basis.

This non-fungibility is akin to owning an original painting; while prints may exist, the original has distinct properties.

Characteristics of NFTs

- Uniqueness: Each NFT has a digital signature. Therefore. it makes it impossible for us to exchange NFTs (hence, non-fungible).

- Ownership and Provenance: NFTs can indisputably prove ownership and provenance, as the blockchain records the entire history of the token’s ownership.

- Interoperability: Built on standard token protocols (like ERC-721 and ERC-1155 on Ethereum), NFTs can be viewed, traded, and owned across various ecosystems.

Common Use Cases for NFTs

- Digital Art: NFTs have gained notoriety in digital art, enabling artists to have ownership over their digital creations.

- Collectibles: We can tokenize any collectible properties or items like digital trading cards and virtual pets as NFTs.

- Gaming Items: In-game assets, such as skins, virtual land, and characters, can be NFTs, allowing players to own their in-game items truly.

- Identity Verification: NFTs can represent digital identities, allowing for unique identification and access privileges within digital platforms.

Advantages of NFTs

- Creator Royalties: Artists and creators can receive royalties automatically via smart contracts whenever they sell NFT to a new owner.

- Market Efficiency: They can make markets more efficient by fractionalizing physical assets like real estate.

- Immutability: Once recorded on a blockchain, the information within an NFT cannot be altered, providing a reliable record of authenticity.

NFT: Controversies and Challenges

- Environmental Concerns: The creation and trading of NFTs typically require significant computational power, as they are built on blockchain networks that consume large amounts of energy. This has raised concerns about the environmental footprint of such activities.

- Market Volatility: The NFT market has shown extreme fluctuations, with prices driven by high speculation.

- Copyright and Intellectual Property Issues: The legalities around the ownership and reproduction rights of NFTs can be complex and are still evolving.

The Future of NFTs

NFTs are redefining the concept of ownership in the digital age. They are expanding the scope of what we can tokenize and trade on a blockchain network. As technology matures, NFTs may influence a variety of sectors, from entertainment and media to real estate and identity verification, reshaping the landscape of digital assets.

Summary of Blockchain Tokens

Examples of a few popular tokens include Civic (CVC), BitDegree (BDG), WePower (WPR), etc.

Tokens don’t have their blockchain network. Their use is on DApps like Ether and NEO, which we have discussed in the altcoin section. And because the building of DApps is on other blockchain networks, the verification of tokens is by using the blockchain nodes available in that network.

Summary

This article discussed various types of cryptocurrencies, e.g., bitcoin, altcoins, and tokens, to understand the use cases and reasons behind various types of cryptocurrencies. The three types of classification discussed are summarized as follows:

- Bitcoin: The first cryptocurrency to revolutionize the world of cryptos.

- Altcoins: Developed by modifications to the bitcoin. Some with minor modifications, such as Namecoin, Litecoin, Dogecoin, etc. Others with major changes, such as NEO and Ether, use smart contracts.

- Tokens: They are only used for the defined specific use case. They don’t have their blockchain network.

Tavish lives in Hyderabad, India, and works as a result-oriented data scientist specializing in improving the major key performance business indicators.

He understands how data can be used for business excellence and is a focused learner who enjoys sharing knowledge.