Startups in Japan: Where Does Japan Stand on the World Stage in 2023?

Startups in Japan picked up slower than in many other developed or developing countries. Japan has been a slow runner in the startup space, which is the first impression people get while analyzing the number of unicorn startups in Japan.

Statistics are important, but sometimes, there are hidden facts behind those plain figures or numbers. In this article, we will focus on all direct and indirect aspects, throwing a better light on the startup scene in Japan.

Moreover, the slow beginning in startups launch in Japan is now picking pace. Japan has started showing signs of becoming more competitive in the startup space. These positive changes are because of the combination of more people trying to become less risk-averse and the improving startup ecosystem in Japan.

By the end of 2021, Japan’s population of 125.8 million was just 1.61% of the world population of 7.79 billion. With such a small share of the world population, this third-largest economy in the world has 53 of the world’s 500 largest companies by revenue.

In other words, we can say that Japan, with just 1.61% of the world’s population, has 10.6% of the Fortune 500 companies. Of course, on the other hand, the fact remains the same: in 2000, Japan was the home of 20% of the Fortune 500 companies.

But what about the startup trend in Japan? Well, we should also be asking if the number of startups or unicorn startups is the yardstick to measure a country’s competitiveness on an innovation scale or business maturity.

This article will discuss the startup scene in Japan, including various statistics and data points.

Let’s dive down.

Startups in Japan – A Peek into the Statistics

However, the impressive statistics mentioned above about the overall industrial growth of Japan do not extend to the startup scene in Japan.

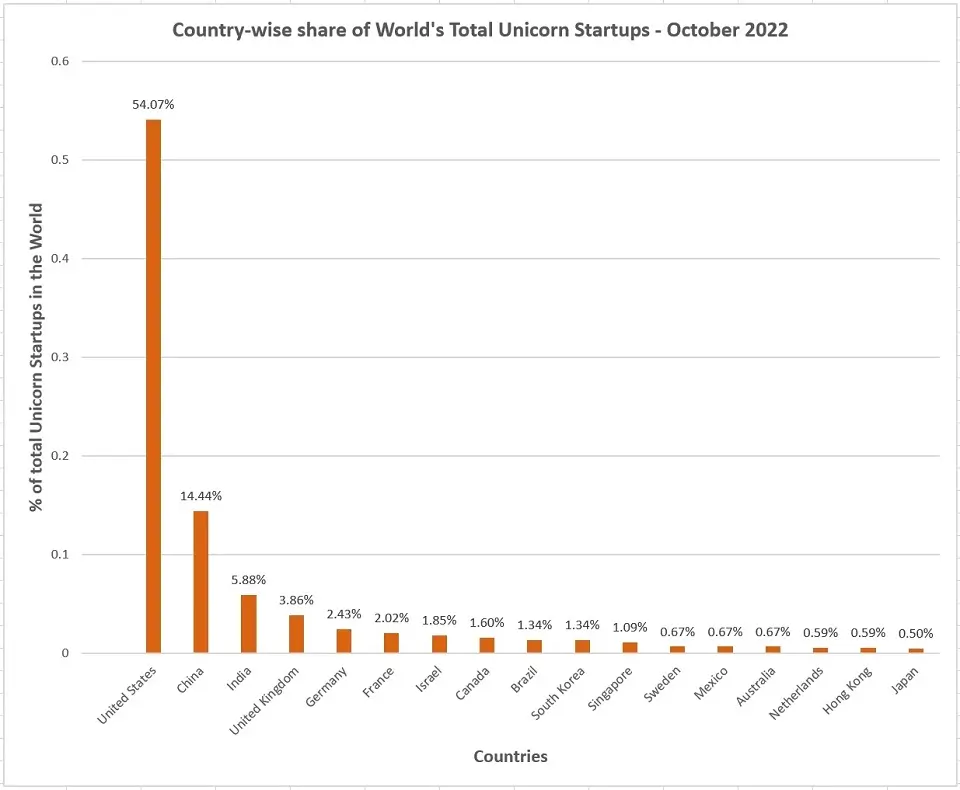

In 2022, Japan had over 10,000 startups. However, the next question is about unicorns in Japan, as to how many unicorn startups are in Japan. As per CBS Insights data of October 2022, with a total number of 6 unicorn startups in October 2022, Japan has just 0.5% of the world’s 1191 unicorn startups. This percentage came down from the first half of 2022 when Japan had 8 out of 943 global unicorn Startups.

However, we will also discuss why Japan’s smaller number of unicorn startups does not present a complete picture of the country’s tech startup landscape and why we need to go more in depth to see why Japan has such fewer unicorns. This is to see if something is more than what meets the eye.

What is a Startup?

Simply put, a startup is a privately held new business to solve a problem or a startup company based on an innovative idea. A startup company aims for speed and growth and starts with a minimum viable product (MVP) with just enough features to check the workability or a prototype but can become a scalable and large business. The MVP goes through continuous iterations to improve it.

What is a Unicorn Startup?

A unicorn startup is a privately held (unlisted) startup with a market valuation of USD 1 billion or more.

Unicorn Startups in Japan Vs. Other Developed and Developing Countries (October 2022)

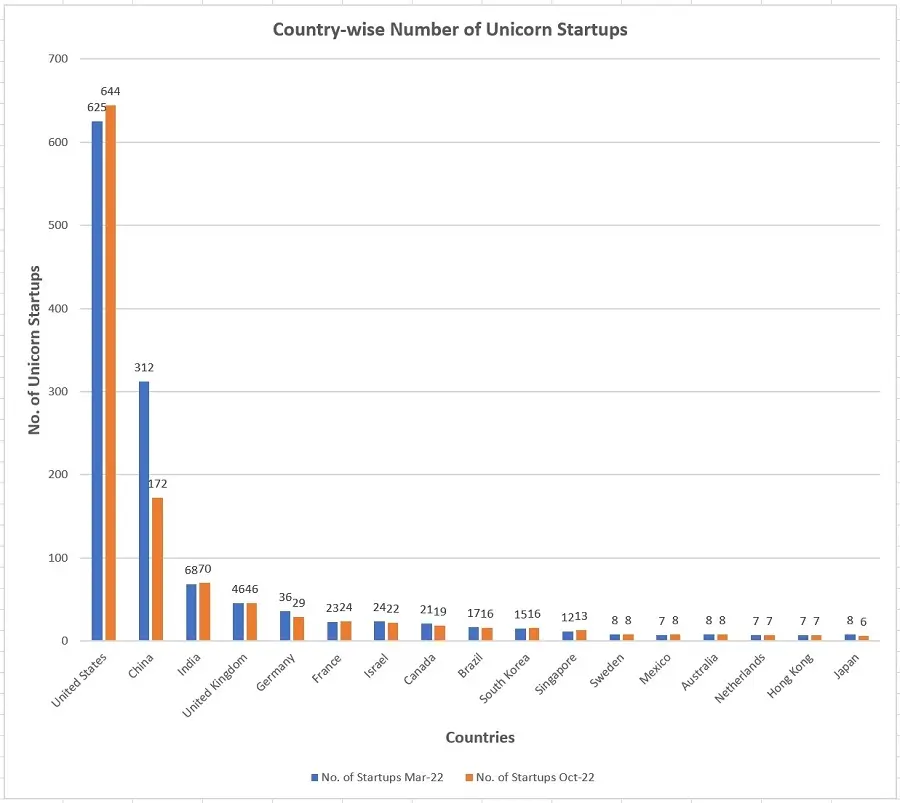

Though the number of unicorn startups at any point is not precisely a measure of any country’s competitiveness in the startup space, it still gives us some idea. The following table and graphs indicate that Japan lags behind most other developed and developing countries’ share of unicorn startups. During the year 2021, Japan had a total of 6 unicorn startups. During the first quarter of 2022, the number had increased to 8. The number of unicorns again dropped to 6 during the last quarter of 2022.

| Country | No. of Unicorn Startups – Mar 2022 | No. of Unicorn Startups – Oct 2022 | % of Total Global Unicorn Startups |

| USA | 625 | 644 | 54.07% |

| China | 312 | 172 | 14.44% |

| India | 68 | 70 | 5.88% |

| UK | 46 | 46 | 3.86% |

| Germany | 36 | 29 | 2.43% |

| France | 23 | 24 | 2.02% |

| Israel | 24 | 22 | 1.85% |

| Canada | 21 | 19 | 1.60% |

| Brazil | 17 | 16 | 1.34% |

| S. Korea | 15 | 16 | 1.34% |

| Singapore | 12 | 13 | 1.09% |

| Sweden | 8 | 8 | 0.67% |

| Mexico | 7 | 8 | 0.67% |

| Australia | 8 | 8 | 0.67% |

| Netherlands | 7 | 7 | 0.59% |

| Hong Kong | 7 | 7 | 0.59% |

| Japan | 8 | 6 | 0.50% |

Graphical Comparison of Unicorn Startups in Japan Vs. Other Countries

Figures do speak more than words, so let’s check the graphical representation of Japan’s share of unicorn startups in the world as compared to some other developed and developing economies:

Japanese Unicorn Startups as a Percentage of Worldwide Total

Unarguably, Japan is one of the technology leaders in the world. Moreover, Japan has an impressive history of technological innovations. It is also the world’s third-largest economy. Considering all these facts, it looks surprising that the number of startups in Japan does not look very impressive. So, why does Japan lag behind other major developed and developing economies in startup success?

To go deeper into the answer to the above question, let’s first see what it needs to be the leading force for startup success. However, before that, let’s see if only the number of unicorns paints the correct picture of a country’s competitiveness as a growing startup economy.

Few Unicorn Startups in Japan Don’t Tell the Correct Story

Though we can get a fair idea of a country’s competitiveness in its startup ecosystem by analyzing the number of unicorn startups and technological innovations, it does not give an overall picture.

Japan is not an exception here. Let’s dive deep into some of the factors why the fewer unicorns do not paint the complete picture of Japan’s technological innovations.

Startups reaching billion-dollar valuations without becoming unicorns

The above heading may sound strange, but a deeper analysis of Japanese startups would justify it. A startup remains until it’s privately held and does not become a listed company. An exit through IPO strips off the company’s startup and Unicorn startup status, even if the valuation is USD 1 billion or more. To be termed a unicorn startup, the startup has to be an unlisted company at the time of reaching a valuation of USD 1 billion or more.

Unlike many other countries, Japanese startups have more exits through an IPO than by M&A, i.e., Mergers and acquisitions. Between 2011 and 2021, 41 Japanese startups exited by getting listed, with a valuation of US$ 1 billion or more. A valuation of that order through M&A would have given them unicorn status in Japan. However, the type of exit cannot be considered a measure of success or failure. If we could consider these hidden gems of tech startups of Japan as unicorn startups, then Japan would have been at the 4th rank on the global chart with 3.95% of the world’s unicorn startups in the country.

Unicorn in One Country – Not a Unicorn in Another

There are numerous definitions of a startup. One widely accepted definition of a startup is by Steve Blank, a serial entrepreneur and professor at business schools such as Stanford, Berkeley, and Imperial College. A couple of other definitions of the startup can be found here.

Practically speaking, a startup is founded by either a solo founder or a small group of solo co-founders. Hence, a company may be founded in one country as a startup by a small group of founders, while in some other countries, the same business cannot be termed as a startup if founded by an existing big business. In such a case, the said business can’t be termed a unicorn even after reaching a billion or more valuation in US dollar terms. An example of the same is Paytm of India, which came up as a startup, and PayPay of Japan, which big groups of companies in Japan founded.

Japan’s Unicorn Startups (October 2022)

As on October 7, 2022, the following Japanese startups had unicorn status:

| Name | Founded | Valuation (October 2022) | Products/Services |

| SmartNews | June 2012 | USD 2.00 billion | App to discover and deliver top 0.01% news from around the world. |

| Preferred Networks | March 2014 | USD 2.00 billion | Developing practical, real-world applications of deep learning, robotics, and other advanced technologies. |

| SmartHR | January 2013 | USD 1.60 billion | HR cloud software optimized for labor management solutions |

| Spiber | September 2007 | USD 1.22 billion | New-generation biomaterial development (Spiber’s Brewed Protein™) |

| Opn | 2013 | USD 1.00 billion | Fintech solutions and products |

| Playco | 2020 | USD 1.00 billion | The instant gaming company focused on building games people can play together without additional app downloads. |

What does it take for a Healthy Startup Ecosystem?

The Startup culture’s thought processes and work styles differ entirely from traditional corporate culture.

While a corporate environment needs to be very structured with hierarchies, proper procedures, protocols, and guidelines and needs a very disciplined working culture, the essential characteristics for a startup to thrive are Innovativeness, extreme agility, speed, the ability to think out of the box and if needed to change directions abruptly, real-time communication and adaptability with risk appetite.

Traditional corporate culture needs a top-down approach where all must follow the company’s core values and vision. While a startup cannot completely ignore these aspects, startups need to be more open to valuing individual ideas and identities. A startup cannot afford to follow a rigidly structured and disciplined work style.

Startup Culture in Nutshell

- Innovativeness

- Thinking out of the box

- Open discussions and the ability to put ideas across openly

- Agility and adaptability

- Extremely fast-paced

- Ability to change directions

- A lot of risk appetite

- Not hierarchical and formal

So, while Japan has no shortage of innovativeness, one significant challenge is meeting the thought process and cultural requirements necessary for a startup.

Startup culture and Japan

Japanese society and culture are known for the following:

- Discipline

- Process-oriented

- Group harmony and respect for others

- Being quiet and less talkative

- Safety and hence risk aversion (fear of failure)

- To show constraint and not be confrontational

- Formal culture

Most of Japan’s deeply rooted cultural aspects sharply contrast with what a startup culture demands. As a result, people taking risks to start their business around a new concept is a challenge. Moreover, the demand-supply gap of available talent, which fits the demands of speed and growth of a startup, is also a challenge.

Other Factors Influencing Startups in Japan

Traditionally, some of the mega-corporations controlled Japanese businesses. These were mainly trading houses and banks. And there was a clear distinction between business people and the employed workforce, called salarymen in Japan.

Generally, Japanese people would pass out of college, look forward to joining large corporations, and stay with that company until retirement. Working with big brands has been a status symbol and has always been regarded as the best safety net for a person’s career. A startup does not meet these requirements; hence, many Japanese people hesitate to join startups. Eventually, this factor affects the startup scene in Japan greatly.

Japan is a country known for risk aversion. As a result, only a few Japanese people thought of going for entrepreneurship to start their businesses. Moreover, a startup with new ideas always has more associated risk factors than a traditional business. This factor also makes many Japanese people resist founding a startup company.

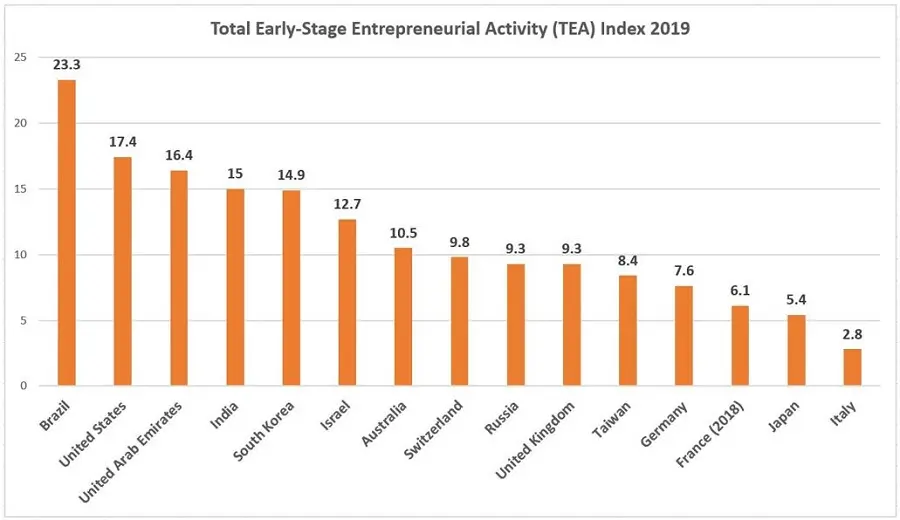

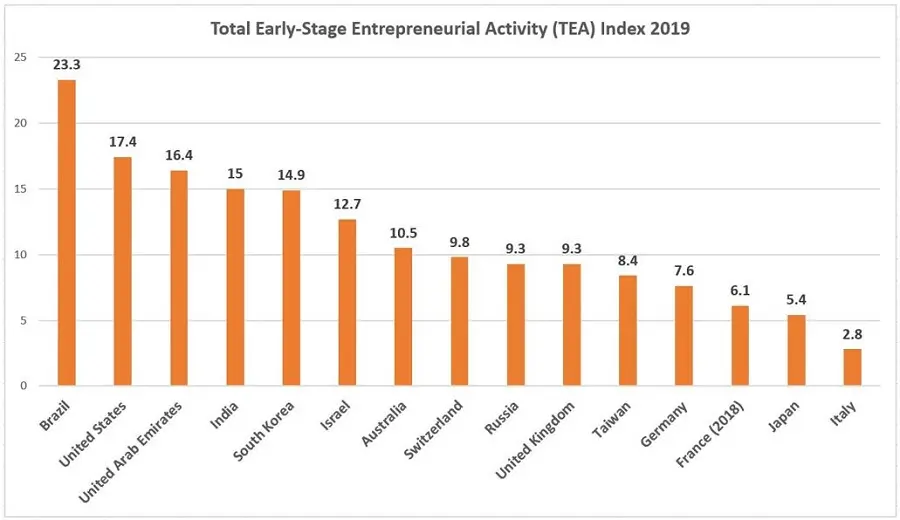

The situation has been changing rapidly but is still far from many other developed and developing countries. The TEA (Total Early-Stage Entrepreneurial Activity Index) index indicates this fact. We will see that Japan has one of the lowest TEA indexes among most other developed and developing economies. And that has been one of the factors about comparatively lesser than expected startups coming up in Japan.

The Global Entrepreneurial Monitor began in 1999 as a joint research project between Babson College (USA) and London Business School (UK). As a result, GEM has become the richest source of reliable information on the state of entrepreneurship and entrepreneurial ecosystems across the globe.

GEM publishes the Total Early-Stage Entrepreneurial Activity (TEA) Index to broadly gauge what percentage of their adult population is trying to start a new business or has created a new business within the past three and a half years.

The following graph shows that while Brazil leads the pack with the TEA index rating of 23.3, followed by the US at 17.4, Japan lags far behind with a rating of just 5.4.

TEA (Total Early-Stage Entrepreneurial Activity Index) of Various Countries

Is the Startup Ecosystem Changing in Japan?

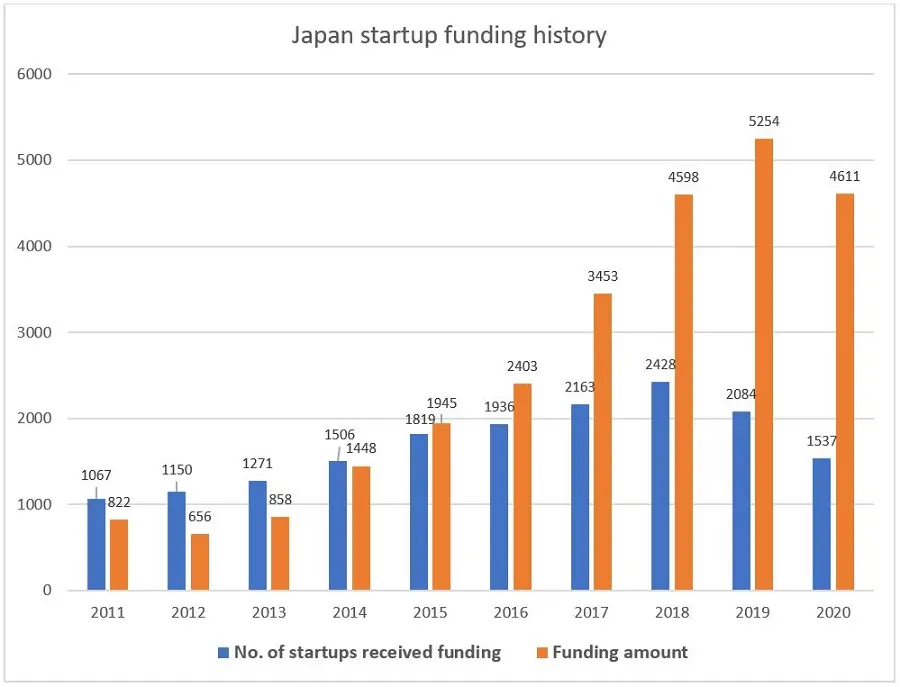

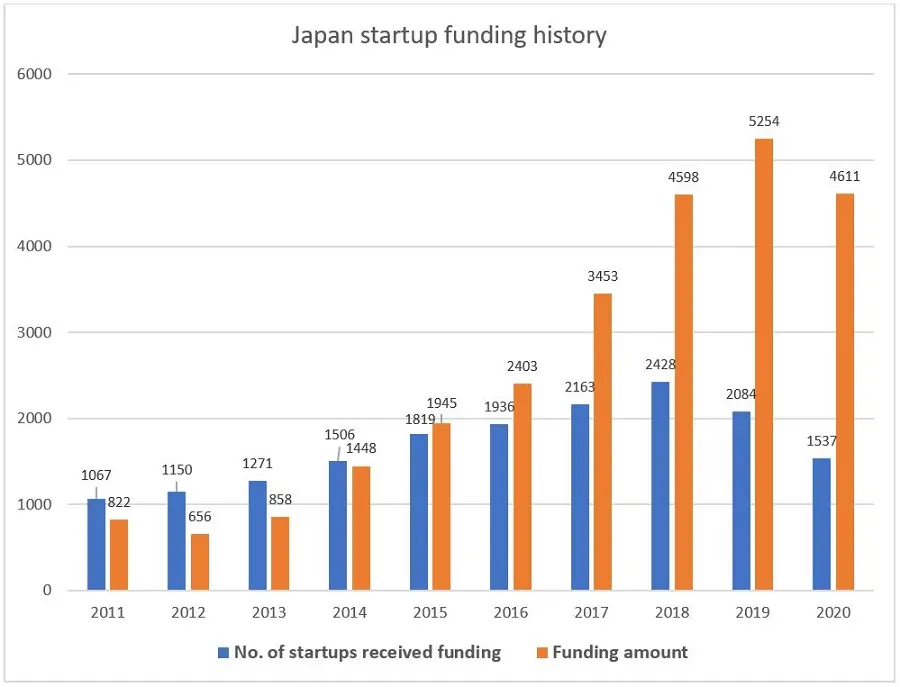

Yes, the startup ecosystem is changing and changing for good in Japan. The following graph represents the changing scenario:

History of Startup Funding in Japan

Source: Japan Startup Finance Report from Initial Inc.

Notes about the above data:

- The data included deals with undisclosed amounts of startup funding in Japan

- Given the nature of the data, the figures are subject to change as the survey progresses

- The year 2020 should be discounted because of COVID

During the first half of 2021, 3234 million JPY (USD 3.01 billion) disclosed that 1014 startups received funding in Japan. In the first half of 2021’s performance about the received funding was the highest.

So yes, the overall picture of Japan’s startup scene is promising. Till 2018, there has been continuous growth in the number of startups. Still, the more important point is the improvement in the amount of funding to startups in Japan.

Startups can’t flourish only because of ideas, problems they address, or technology. All these things can only get a boost from money. So, whether it is a traditional business or an upcoming startup, money is the ultimate driver for business success. The growth in funding to the startups shows the improving confidence of venture capitalists and other entities in the Japanese startup ecosystem.

What is bringing change to the situation of startups in Japan?

Following are the three main factors that are influencing the growth of startups in Japan:

- Globalization

- Increasing risk-taking appetite

- And then some pioneer companies bent upon bringing a change

1. Globalization

Japan rose like a phoenix from the ashes surprisingly shortly after World War 2. It was a remarkable growth story, where the rising economic world power focused on dominating the domestic market. However, success can also have a significant negative side because it sometimes makes us complacent and kills the ability to be agile and to focus on change.

Before continuing with the above, let us consider some facts:

- During the mid-1990s, Japanese Fortune 500 companies’ contribution to the total revenue of Fortune 500 companies used to be around 35%. This dropped drastically to 9.38% in 2019. That means that in 1019, Japanese Fortune 500 companies generated just 9.38% of the total revenue generated by all the Fortune 500 companies. If we talk in actual figures, in 2019, Japanese Fortune 500 companies’ total revenue was 3.12 trillion USD, while the total revenue of all the Fortune 500 companies was 33.3 trillion USD.

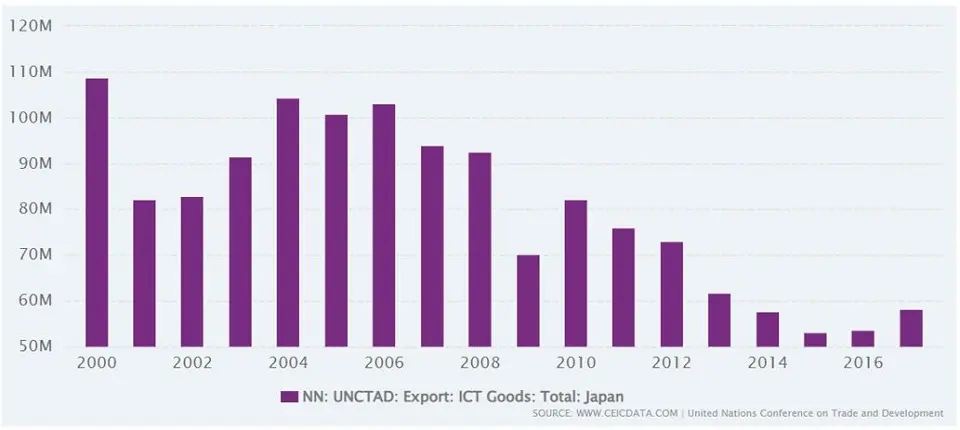

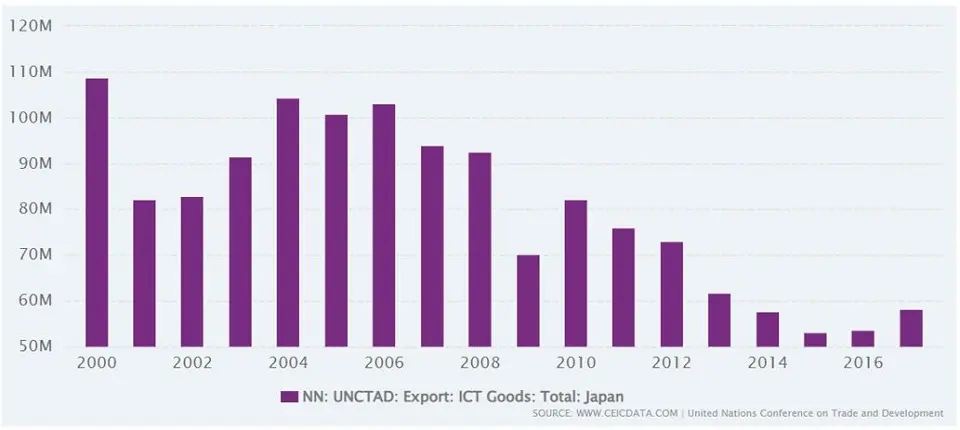

- Similarly, the ICT Goods exports by Japan have been going to new lows while countries like S. Korea, Taiwan, China, etc., have been doing better by the day.

Historical Figures of ICT Goods Transport by Japan

Another point looming like a large dark cloud on the horizon is that Japan’s current 125.8 million population is predicted to shrink to less than 100 million by 2040-2050. So, can Japan survive by focusing mainly on the domestic market?

Eyes have started opening up for speedy globalization, not just for business but also in society and culturally, which has started bringing a change that should keep picking pace. These changes will ensure continuous improvement in Japan’s startup ecosystem and overall startup scene.

2. Increasing Risk-taking Appetite

Risk appetite increases when people face dangers directly. Knowing we are safe makes us wish for more safety and less consciousness of possible risks. Japan is known for being a very safe country. The economic growth over decades, combined with the traditional jobs-for-life employment system, seniority-based wage systems, and a strictly rules-based society, had kept uncertainties out of Japanese people’s lives to make them more risk-averse.

However, some events have been causing Japanese society to be more exposed to uncertainties and risks. First, the Lehman shock of September 2008 caused 940,000 job losses in one year, and very soon after, the 2011 Tsunami did that to Japan. COVID-19 is not specific to Japan but adds to the chain of events.

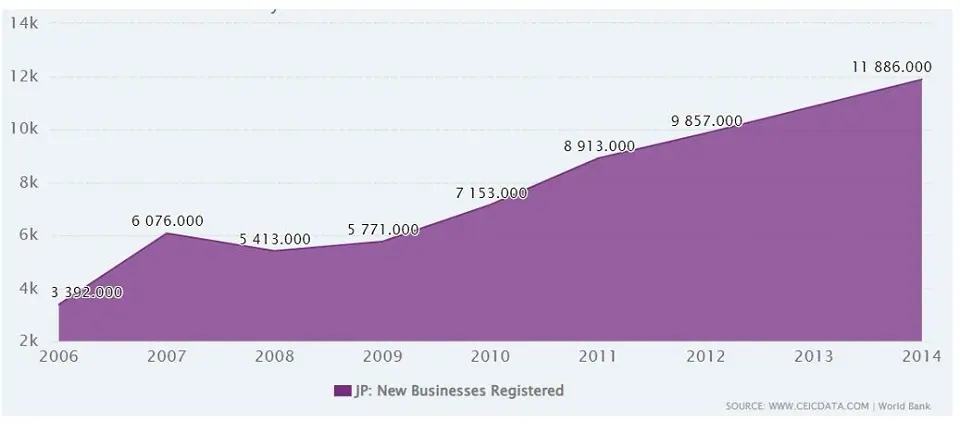

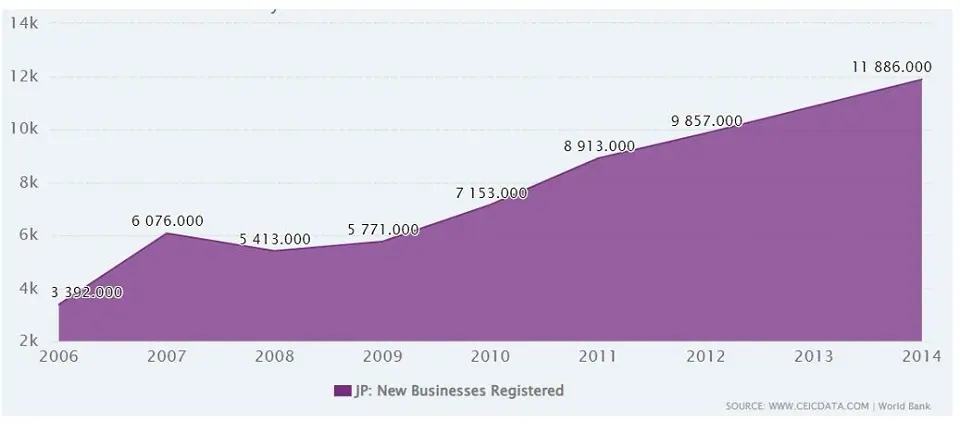

The increasing risk-taking appetite is evident in job-hopping among Japanese people, and more people are considering freelancing or even starting their businesses. The following graph of the World Bank data indicates the trend of increase in new businesses and startups in Japan:

The Trend of Increasing New Businesses in Japan

3. Modern Japanese Companies Leading a Cultural Revolution

Recently, Some Japanese companies have been breaking the traditional approach to bring more diversity and be more competitive globally. Companies like PayPay and Mercari etc. take pride in the diversity of their employees, coming from over 40 different countries in Japan.

Some Japanese companies have adopted English as their official language or one of their official languages. And some have been attracting more and more foreigners as employees with no emphasis on Japanese language skills. This trend is more in the Information Technology space. And that is important for more and more technology startups taking birth in Japan.

Some of such Japanese companies are as follows:

- PayPay

- Rakuten

- Line

- Fast Retailing

- Shiseido

- Honda

- Bridgestone

- Nissan (40% of Corporate Officers are non-Japanese)

Cultural changes are always slow, but the beginning is essential. And the waves of changes have already started. These changes and the influx of more and more foreign employees in the Information Technology space, the more risk-taking appetite of Japanese people, and the increasing overall globalization should put Japan as one of the major players on the world’s startup map.

Improving Startup Ecosystem in Japan

A robust startup ecosystem is the most critical factor for any country to be competitive in the startup space. The startup ecosystem is a joint effort to improve community & social networks, investment support, infrastructure support, and skills development. In addition, this ecosystem is enhanced by the collaborative efforts of various related entities to ensure that the country becomes competitive.

The entities that make up this startup ecosystem are people, startups, government, regulatory bodies, and all associated organizations that can help new entrepreneurs grow, succeed, and scale their startups and help them make the startups sustainable large businesses.

The Japanese startup ecosystem has been improving with central & local governments’ involvement and industry support.

Japan’s government launched a special Japanese startup visa to attract foreign entrepreneurs to Japan. As of 2022, this program is supported by the following 14 municipalities in Japan:

- Fukuoka City

- Kobe City

- Osaka City

- Kyoto Prefecture

- Hokkaido Prefecture

- Gifu Prefecture

- Sendai City

- Ibaraki Prefecture

- Shibuya City Office, Tokyo

- Yokohama City

- Hamamatsu City

- Aichi Prefecture

- Mie Prefecture

- Oita Prefecture

Apart from the visa support to promote startups, METI (Ministry of Economy, Trade, and Industry of Japan), in collaboration with JETRO (Japan External Trade Organization) and NEDO (New Energy and Industrial Technology Development Organization) had come up with the J-Startup initiative. J-Startup connects startups with the Government and other startup supporters, i.e., large corporations, VCs, and accelerators, to support the startups of Japan.

Other Government and Private Sector Initiatives to Develop the Startup Ecosystem to Support Startups in Japan

- J-Startup City

- Central Japan Startup Ecosystem Consortium

- University of Tokyo Startup Support

- Tokyo Metropolitan Government Startup Support

- Toyota Startup Accelerator Program

- Honda Xcelerator

- Google for Startups Accelerator

Conclusion

Japan has been known for technological innovations, and innovations are the seeds of building a startup economy. Unfortunately, Japan seemingly lagged in the startup race because of some of the cultural issues like risk aversion and other factors related to culture and tradition.

The support infrastructure to build a robust and efficient startup ecosystem could have been more efficient. However, things are changing fast, and there is no doubt that with innovative mindsets, Japan is on its way to making its mark in the global startup scene.

Moreover, we also saw that we need to take the number of unicorn startups in Japan at face value. The number of startups in Japan that reached a US$ 1 billion or more valuation is much higher than the number of unicorns mentioned in the news and articles. This was purely due to more exits taking place with the IPO route. However, the type of exit of startups cannot be treated as a yardstick to measure the success of Japanese startups.

A long-term ex-pat in Japan, Himanshu comes with an IT background in SAP consulting, IT Business Development, and then running the country operations of an IT consulting multinational. Himanshu is the co-founder and Managing Director of ReachExt K.K. and EJable.com. He is also an Advisory Board Member of a Silicon Valley AI/IoT startup.